how to get tax exempt certificate ohio

Exempt verification letter which states the basis of the organizations exemption. Sales and Use Tax Resale Certificate.

Tax Collection And Documentation Requirements For Nonprofits And Tax Exemption

Printable Massachusetts Sales Tax Exempt Purchaser Certificate Form ST-5 for making sales tax free purchases in Massachusetts.

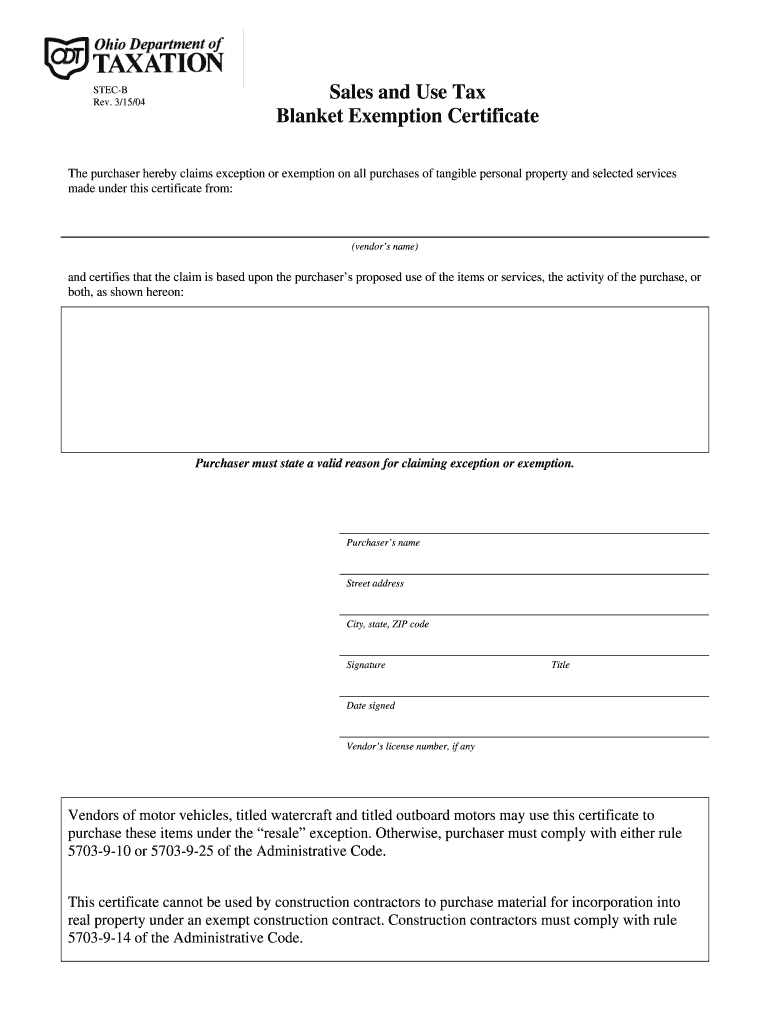

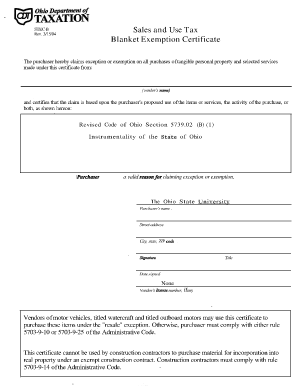

. Taxohiogov under the Tax Forms link. The Unit Exemption Certificate is utilized for the majority of tax exempt purchasing procedures and the Blanket Exemption Certificate is the blanket version of this form. In order for a not-for-profit to be exempt the organization must apply for and be granted exempt sales and use tax status in the states in which they conduct business.

Local Sales Tax will remain imposed at a tax rate of 1. Multistate Tax Commission Uniform Sales and Use Tax Certificate. If you expect to owe more Ohio income tax than the amount withheld from your compensation you can request that your employer withhold an additional amount of Ohio income tax.

There are two kinds of tax years. And you are enclosing a payment then use this address. There are often different certificates for different situations or industries as seen on the New York State Department of Taxation and Finance Exemption Certificates for Sales Tax page.

GSA 7437 - Art In Architecture Program - National Artist Registry - Renewed. These forms may be downloaded on this page. Exempt organizations must keep books reports and file returns based on an annual accounting period called a tax year.

Organizations that want to specify an annual accounting period generally do so in their bylaws. State Tax Exempt Forms. The Commission has developed a Uniform Sales and Use Tax Certificate that 38 States accept for use as a blanket resale certificate the use of this certificate is.

GSA 1260 - Security Resolution Certificate for Fire Alarm Communicators - Revised - 832022. Please contact your tax athlsor to determine If your purchases qualify for sales tax exemption. More information can be obtained from the individual state tax office website.

You may use an out-of-state sales tax license number to fill out these forms. Visit GSA SmartPay to find state tax exemption forms andor links directly to state websites. If you meet any of the below specifications you will also need to file and remit on the Sales and Use Tax return CST-200CU.

The sales tax number and resale certificate are commonly thought of as the same thing but they are actually two separate documents. However a business requires a federal Employer Identification Number EIN first before applying for a tax-exempt resale certificate. A tax-exempt resale certificate can usually be obtained by a business from the state or local tax office.

And you are not enclosing a payment then use this address. Create a free Tax Exempt Certificate in minutes with our professional document builder. To get a resale certificate in Arizona you may complete the Arizona Resale Certificate Form 5000A the Multistate Tax Commissions Uniform Sales and Use Tax Certificate or the Border States Uniform Sale for Resale Certificate Form 60-0081.

A tax exempt certificate is issued to an entity that qualifies for an exemption or because the purchased item qualifies for the exemption. The Registered Retail Merchant Certificate allows a business to sell and collect sales tax from taxable products and services in the state while the Sales tax exemption certificate allows the retailer to make tax-exempt purchases for products they intend to resell. All of the above forms are available on the Ohio Department of Taxation website.

As a convenience if your sales occur exclusively in the district you can report and pay this tax as a part of the Special District Excise return. A tax year is usually 12 consecutive months. Or Amazon Semces LLC.

And you are filing a Form. Your dependents for Ohio income tax purposes are the same as your dependents for federal income tax purposes. Ohio accepts the Uniform Sales and Use Tax Certificate created by the Multistate Tax Commission as a valid exemption certificate.

Tax exempt organizations such as nonprofit organizations schools government entities must provide the following items when claiming exemption from sales taxes. The state of Ohio provides certain forms to be used when you wish to purchase tax-exempt items such as prescription medicines. State-issued exemption and resale certificates can be found on a state tax authoritys website.

How to register for an Indiana Registered Retail Merchant Certificate. In instances where similar transactions routinely occur between a buyer and a seller eg a. The sales tax number allows a business to sell and collect sales tax from taxable products and services in the state while the resale certificate allows the retailer to make tax-exempt purchases for products they intend to resell.

The processes of obtaining. If you live in Ohio. Department of Treasury Internal Revenue Service Ogden UT.

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Tax Exempt Form Ohio Fill Online Printable Fillable Blank Pdffiller

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Filling Out Ohio Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Printable Ohio Sales Tax Exemption Certificates

Ohio Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Tax Exempt Form Ohio Fill Out And Sign Printable Pdf Template Signnow

Free Form Stec U Sales And Use Tax Unit Exemption Certificate Free Legal Forms Laws Com

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Ohio Sales Tax Exemption Signed South Slavic Club Of Dayton

Tax Exempt Form Ohio Fill And Sign Printable Template Online Us Legal Forms

New Bulletin Explains Ohio S Sales Tax Exemptions For Agriculture Farm Office

Ohio Sales Tax Exemption Fill Out Printable Pdf Forms Online

Tax Exempt Form Ohio Fill Online Printable Fillable Blank Pdffiller

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com