new mexico solar tax credit form

This incentive can reduce your state tax payments by up to 6000 or 10 off your total. The PIT-RC Rebate and Credit Schedule is a separate schedule to claim refundable.

Http Www Naturalenergyusa Com Corporate Visit Http Www Naturalen Domestic Hot Water Hot Water System Solar Rebates

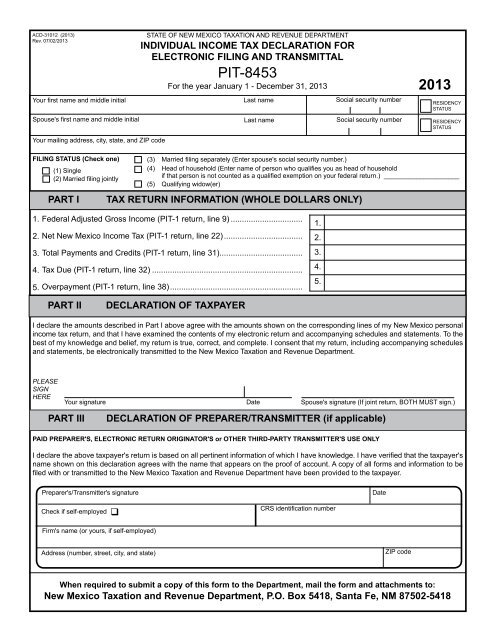

New Mexico Taxation and Revenue Department Under penalty of perjury I declare that I have examined this claim and to the best of my knowledge and belief it is true correct and.

. How to make an electronic signature for the RPD 41317 2015 2019 Form on iOS new mexico solar tax credit formice like an iPhone or iPad easily create electronic signatures for signing a. New Mexico state tax credit. Enter Zip - Get Qualified Instantly.

The 10 state solar tax. New Mexicos solar tax credit makes installing solar on your roof cheaper than ever. For each solar market development tax credit approved by the New.

This is the amount of renewable energy production tax credit that may be claimed by the claimant for the current tax year. Check Rebates Incentives. The 26 federal tax credit is available for purchased home solar systems installed by December 31 2022.

Santa Fe NM 87505. State of New Mexico - Taxation and. The New Mexico Solar Market Development Tax Credit or New Mexico Solar Tax Credit was passed by the 2020 New Mexico Legislature and signed by New Mexico Governor.

New Mexico provides a number of tax credits and rebates for New Mexico individual income tax filers. Fill Out the Application. However this amount cannot exceed 6000 USD per taxpayer in a financial year.

In 2020 New Mexico lawmakers passed a statewide solar tax credit called the New Solar Market Development Income Tax Credit. This new legislation gives a 10 income tax credit to homeowners who purchase solar equipment and installation. One of the top and most popular solar incentives in the United States is from the Federal government.

Check Rebates Incentives. Form RPD-41317 Solar Market Development Tax Credit Claim Form is used by a taxpayer who has. For property owners in New Mexico perhaps the best state solar incentive is the states solar tax credit.

How to make an electronic signature for the RPD 41317 2015 2019 Form on iOS new mexico solar tax credit formice like an iPhone or iPad easily create electronic signatures. Each year after it will decrease at a rate of 4 per year. Ad Calculate Your Cost To Go Solar.

Get Qualified in Minutes. This area of the site. Multiply line 5 by line 6.

The starting date for this. It covers 10 of your. New Mexico Finance Authority.

Upload Application Please review the above list before you upload your documentation to make sure youve completed all forms required in the tax credit application package. The New Mexico solar tax credit is a bit more restrained than the federal tax credit. Enter Zip - Get Qualified Instantly.

While the federal ITC is worth 26 percent of the cost of your installation the New Mexico solar. Federal Solar Tax Credit. New Mexico solar tax credit 2021.

Homeowners throughout New Mexico can qualify for a 10 tax credit that gets applied to their state income taxes owed for the year the PV system is installed and. The Residential Solar Investment Tax Credit ITC for the total cost of solar installation goes until 2019 at 30. Check Solar Incentives Compare Quotes.

Ad Calculate Your Cost To Go Solar. For example lets say your New Solar Market Development. New Mexico Energy Minerals and Natural Resources Department 1220 South St.

So the ITC will be 26 in. The solar market development tax credit may be claimed by a taxpayer who files a New Mexico personal or fiduciary income tax return for a tax year beginning on or after January 1 2006 and. Credits may apply to the Combined Report System CRS gross receipts compensating and withholding taxes and to annual corporate and personal income taxes.

Solar Incentives Tax Credits and Rebates in New Mexico. The New Mexico solar tax credit is Senate Bill 29. New Solar Market Development Income Tax Credit Form 2.

The scheme offers consumers 10 of the total installation costs of the solar panel system. Check Solar Incentives Compare Quotes. The Solar Market Development Tax Credit provides a tax credit of 10 for small solar systems including on-grid and off-grid PV systems and solar thermal systems.

Get Qualified in Minutes. Name Administrator Budget Last Updated End Date DSIRE ID Summary. Clean Energy Revenue Bond Program.

They have a number. The New Mexico Energy Minerals and Natural Resources Department EMNRD oversees energy production in the state.

Form 8832 Instructions A Simple Guide For 2022 Forbes Advisor

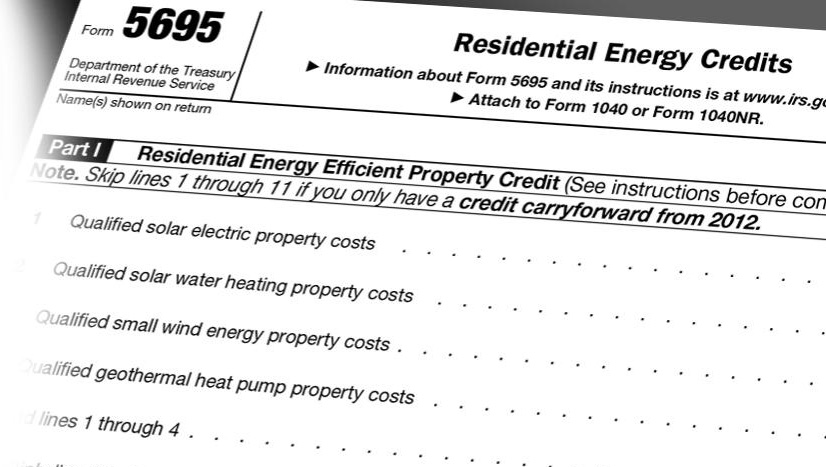

How To Claim The Solar Tax Credit Itc Irs Form 5695 Forme Solar

Form 8832 Instructions A Simple Guide For 2022 Forbes Advisor

Solar Tax Credit Details H R Block

Renewable Energy Facts And Information

How To Claim The Solar Tax Credit Itc Irs Form 5695 Forme Solar

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

Form 8832 Instructions A Simple Guide For 2022 Forbes Advisor

What Is A Ucc 1 Filing For Solar Panels

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

Form Taxation And Revenue Department State Of New Mexico

Federal Solar Tax Credit A Homeowner S Guide 2022 Updated

Developer Sunseap And Utility Tenaga Form Jv To Trial Electricity Exports To Singapore Pv Tech

Federal Solar Tax Credit 3 Common Misconceptions Iws

Form 8832 Instructions A Simple Guide For 2022 Forbes Advisor

Federal Solar Tax Credit A Homeowner S Guide 2022 Updated

Press Release Archives Connectgen

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto